To hear more from the panellists, watch our video recap!

On 6 August 2021, the second TechTalks by GET installation opened with Henry Chong, Chief Executive Officer of Fusang Corporation with a talk titled “Challenges of Building a Digital-First Business”. Hailing from a background in traditional wealth management, Henry pioneered Fusang Exchange which is Asia’s first fully-regulated digital stock exchange.

In the first part, Henry gave an overview of the history of shares, how Fusang is capitalising on technologies to manage digital assets and what it means to convert your shareholders into stakeholders.

The discussion then opened to the floor with panellists Rashdan Yusof, Deputy Group Managing Director and Group Chief Investment Officer, and Bryan Chua, a software engineer from Gamuda Engineering.

If We Don’t Disrupt Our Business, Someone Else Is Going To Do It For Us. Because Any Business Based On People And Paper In The 21st Century, I Don’t Think, Belongs To This World

Henry Chong, Fusang Corp.

Below are select extracts which had been paraphrased for clarity and brevity.

Question: What’s the greatest challenge in your digital transformation journey, especially for a large organisation?

Henry: The problem is rarely technology, it’s usually people, sometimes within the organisation itself. I think the most important thing is having people with the right mindset, where they don’t get caught up in the technology but focus instead on the job to be done, and asking the question of what are we doing for our customer. Uber, for example, was one of the earlier companies to look at this space and asked themselves, “What business are we really in?” Are we in the business of providing an app that you can tap on and find a car? Are we in the transportation and logistics business? Are we just then an on-demand transportation logistics business? By defining what you do, you will find yourself innovating towards your customers’ needs and adopting different technologies.

There’s no magical solution to it but to take one step at a time and focus on the constant process of innovation. Even a 1% difference in growth rate can compound powerfully over time.

Another example is Netflix which isn’t so much fixated on its future strategies than it is focused on getting better content in front of people every day. It’s not a big bang that happens overnight.

Bryan: Because of the nature of large organisations, we may be less agile than start-ups or smaller companies when it comes to transformation. Say, for example, banks, they’re being disrupted by the fintech sector with alternatives like robo-advisors, crowdfunding platforms etc, and sometimes they can be rather afraid of these new players. If we want to work faster and better, we should embrace the mindset of these start-ups.

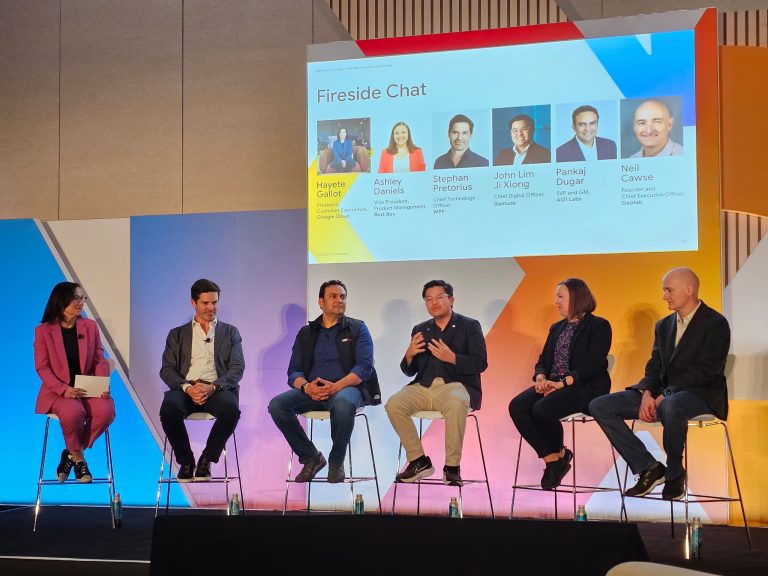

Screenshot of the panellists answering questions from the audience

Question: What are some applications in fintech that may be transferable to the construction industry?

Rashdan: Banking and construction have been some of the industries slowest to change. But one key area that we can apply data science is safety. Something as catastrophic as the condominium collapse in Florida should never happen. If we used our data effectively to improve how we build, we’ll be much better at it.

I am inspired too by Elon Musk’s work with The Boring Company. It is purported that the cost per kilometer of his tunnel is far lower than the typical construction. The waste material dug up can be repurposed into construction material instead of going to a dumpsite. And we must appreciate the fact that he had rocket scientists on board because there’s certainly value in seeing an existing problem with a fresh pair of eyes.

Question: How could Malaysia be more inclusive in the cryptocurrency world?

Henry: Malaysian regulators have been quite forward-thinking. Regardless if it’s a piece of paper or a blockchain-based token, generally the principles of what regulators do haven’t changed. What is more challenging is for the overall business and industry landscape to follow suit. For example, rethinking what it means to own infrastructure. Imagine if large-scale infrastructures could be funded by individuals rather than just banks and governments?

Rashdan: Going deeper into this inquiry, it is extremely difficult for the average guy on the street to access investments like infrastructure funding or even an IPO (initial public offering). There’s even a large population that is unbanked. E-wallets could be just the thing that helps these people get access to financial services. Likewise, with digital IPOs, the market becomes democratised with direct listings and thus becomes more inclusive.

Question: What are your thoughts on NFT games like Axie Infinity and the short to medium-term prospects for investors?

Bryan: I just recently saw a post of people selling NFTs of the sound of a Coca Cola can opening. These essentially become viable investments because people see value in them. As a young investor, these are exciting avenues that open up both risks and opportunities. I think the key thing is to actively watch the space and be in the know because the future of investing might look very different from what it is now.